Normandy Park City Manager’s Report for week ending Mar. 8, 2024

Information on Property Taxes

The City understands that your annual property tax bill represents one of your most significant annual expenses. We have also heard from many Normandy Park residents who saw an increase in their 2024 property taxes. So, I wanted to take this opportunity to talk about the property tax system and the increase you probably saw this year.

Why did so many Normandy Park residents see increased property taxes in 2024?

The amount of property tax you pay as a resident is based on your assessed value and the total levy rate. In 2024, these two items increased for Normandy Park residents, increasing property taxes for most. Because both these numbers increased, many residents saw a significant increase.

Why did my Total Levy Rate increase?

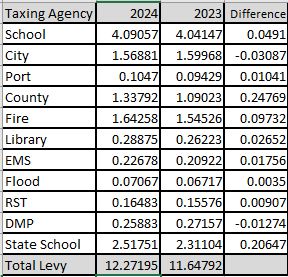

The information provided on the King County Assessor’s website shows that the total levy rate in 2024 was $12.27195, compared to $11.64792 in 2023. Because of this increase, you paid an additional $0.62403 for every thousand dollars of assessed value.

So, not only did the value of your property increase but so did the dollar amount you paid on that value.

Who determines the total levy rate?

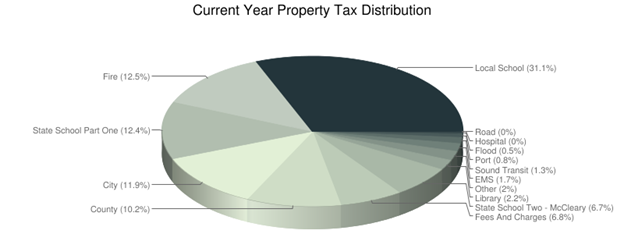

This number combines all the levies set by the taxing agencies that serve Normandy Park. And Normandy Park residents have over ten agencies that levy your property. Here is a table from the Assessor’s website showing your property tax distribution.

As you can see, 50% of your taxes go to schools (both state and local), and the other three primary recipients are the County, Fire District, and the City of Normandy who receives 11.9% of your total tax bill.

Based on information provided by the Assessor, most of the taxing agencies that serve Normandy Park increased their levy rate, which equates to an increase in the total levy rate and your property taxes. Here is a chart that shows the changes in levy rates from 2023 to 2024:

As you can see, the City of Normandy Park was one of a few agencies that reduced its levy amount.

On average, even though the City decreased its levy amount, the dollar amount you paid to the City will most likely increase in 2024. The average increase for a home assessed at approximately $1,000,000 was about $75 for the year. This increase helps us keep up with rising costs and supports your daily services, which include police, permitting, facilities maintenance, community development, and other functions like administration, finance, and clerk support services.

The City appreciates our citizens. And we want to continue to provide outstanding services, and our property taxes help us with that. If you have any questions or need additional information about this topic, please do not hesitate to contact me.

Time Springs forward on Sunday

Don’t forget! On Sunday, March 10th, we will spring forward to daylight savings time.

Still Time to take the Citizen Satisfaction Survey

We will start tabulating the results of the 2024 Citizen Satisfaction Survey soon. If you have not taken the survey, there is still time. Take the survey and let your voice be heard. You can use this link. If you have any questions, please contact City Clerk Erin Smith at [email protected] or 206.248.2848.

If you have any questions, please get in touch with me at [email protected].

“Have a great week!”

Amy Arrington, City Manager

City of Normandy Park

801 SW 174th Street

Normandy Park, WA 98166

(206) 248-8246 (Direct Phone)

Recent Comments